১ ফাল্গুন ১৪৩২

Main Goals are Inflation Control and Employment

National Budget for the FY 2025-26 is about 8 Lakh Crore Taka

02 June 2025 22:06 PM

NEWS DESK

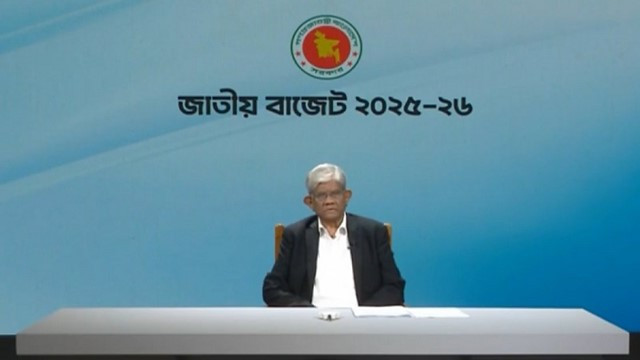

Finance Adviser Dr Salehuddin Ahmed presented a Taka 7,90,000 crore national budget for FY25-26 on Monday with ensuring quality of life for all and developing a system based on non-discrimination at all levels at its forefront upholding the spirit of 2024 mass uprising.

The proposed budget, 12.7% of GDP, has a high focus on curbing inflation further, generating more employments, facilitating trade and commerce, attracting more investments and giving respite to poorer section of people through raising safety net coverage and allocations.

“Our core objective will be to ensure quality of life for all and a system based on non-discrimination at all levels in that future Bangladesh. I seek your wholehearted cooperation to achieve this goal. Inshallah, with the sincere efforts of all of us, Bangladesh will be a beacon of inspiration for all who aspire for freedom,” said Dr Ahmed.

He also said for now, the government is focusing more on strengthening the foundation of the economy instead of accelerating the pace of growth. “This strong foundation will serve as the steppingstone to build a resilient and sustainable future of Bangladesh,” he added.

The Finance Adviser presented the budget speech titled “Building an Equitable and Sustainable Economic System” through an unusual pre-recorded televised one since the Jatiya Sangsad is not in place now.

This was the country's 54th budget and the first of Professor Dr Muhammad Yunus led interim government. In his budget speech, the finance adviser highlighted several key economic indicators and plans across sectors.

He said the foreign exchange reserves rose to $27.4 billion in April due to encouraging growth in remittance inflows and stable export earnings.

The government is also expected to receive approximately $3.6 billion in budget support from various development partners by June this year, the adviser said. To reduce reliance on subsidies in the energy sector, a plan has been undertaken to cut the overall cost of power generation by 10 percent.

In the energy sector, the Finance Adviser said a plan has been adopted to supply 648 million cubic feet of gas from domestic sources within this year and to extract an additional 1,500 million cubic feet of gas from local wells by 2028.

Regarding the banking sector, he informed that the total amount of defaulted loans in this sector increased from 10.11 percent in June 2023 to 20.20 percent in December 2024, as the government adopted the Loan Lease Classification and provisioning system in line with international standards.

In just a few months, the Finance Adviser said the government has almost completed the task of stabilizing the country by overcoming difficult challenges. “However, we still have a long way to go to reach the doorstep of complete success,” he added.

After the July Mass Uprising of 2024, Dr Salehuddin said the interim government took over the responsibility of running the country at a critical time. “We had the difficult task of reviving the economy left by the previous government on the brink of collapse and bringing relief to public lives by removing anarchy,” he added.

He went on saying, “I am delighted that in less than 10 months the Interim Government has already gone a long way in achieving that goal. Insha Allah, we will soon be able to fulfill the aspirations of the people that we envisaged through the July Mass Uprising,”

He said after the July Mass Uprising, the government had to face tough challenges such as taming high inflation, improving the law and order situation, restoring normalcy in the industrial sector by mitigating labor unrest and restoring discipline in the banking sector which was severely damaged due to unbridled corruption and mismanagement during the previous regime.

He said tackling all these risks and ensuring an equitable and sustainable foundation for the country's economy is now the top priority. “For now, we are focusing more on strengthening the foundation of the economy instead of accelerating the pace of growth. This strong foundation will serve as the steppingstone to build a resilient and sustainable future of Bangladesh,” he said.

The Finance Adviser said, “We are already on the verge of achieving stability due to a robust inflow of remittance, continuous growth in export earnings, continued production in agriculture and industrial sectors, and coordinated implementation of befitting monetary and fiscal policies.”

He said, however, there are still risks in the way of achieving complete stability and reviving the economy back to its normal state.

“Our main objective is to build a society based on the Zero Poverty, Zero Unemployment and Zero Carbon principle where everyone will have a decent life and will be free from the vicious cycle of discrimination,” he added.

The Finance Adviser said the government wants to leave a livable habitat for the next generation by implementing the dream with which the foundation of the July Mass Uprising was made. “We want to bring radical improvements to the quality of people's lives,” he said, adding that they tried to arrange this year's budget keeping these goals in mind.

“Without ensuring the essential elements of guarantee of fundamental rights, necessary measures for good living, security of livelihood and environment free from discrimination, any state becomes ineffective, and the foundation of a society is weakened,” he said.

Considering this, he said in this year's budget, special emphasis has been laid on education, health, good governance, civic facilities, employment etc.

Besides, realizing the benefits of the Fourth Industrial Revolution, preparing for the post-LDC graduation period, mitigating the risks of climate change and ensuring sustainable development have been given appropriate priorities, he added.

“Those who sacrificed their lives in the July Mass Uprising left a rare opportunity before us to lead the country in the right direction and build a strong foundation for the future,” he said.

The Finance Adviser said the main mission in the coming days will be to establish good governance and fulfill the commitment of institutional reforms to reach that goal with all-out cooperation from the citizens.

The proposed budget for the next fiscal year focused on boosting the tax-GDP ratio, facilitating the local industries, attaining desired revenue collection growth, creating new employments, attracting FDI, creating business friendly environment, minimizing compliance gap, simplifying the accounting system of VAT.

Compared to the previous year, the proposed budget is Taka 7000 crore lower than the current fiscal year’s original allocation of Taka 797,000 crore.

Compared to the previous year, the overall size of the budget is slightly smaller -- Taka 7,90,000 crore, down 0.87 percent from the current fiscal year. The development budget was reduced by Taka 35,000 crore to Taka 2,30,000 crore, while the operating or other expenditure will go up by Taka 28,000 crore to Taka 5,60,000 crore.

Fiscal policy will prioritise tighter coordination with monetary policy while the budget is expected to reflect recommendations from key reform commissions and task force reports.

The Finance Adviser also proposed to increase special benefit for the government employees in the budget of FY2025-26 as no pay scale has been declared after 2015.

The projected budget deficit would stand at Taka 226,000 crore, down from Taka 256,000 crore in the current fiscal year, representing 3.6% of the GDP. To meet the budget deficit, the government will rely on foreign borrowings, bank loans, and savings certificates.

To alleviate the financial strain on lower-income groups, the budget includes an expansion of social safety net programs, increasing both beneficiary numbers and allowance amounts. Key sectors like agriculture, health, education and technology would be prioritised for availing funding.

The Annual Development Programme (ADP) allocation is projected at Taka 230,000 crore, a reduction from Taka 265,000 crore in the current fiscal year, signifying a more focused investment approach.

The revenue collection target for FY26 has been set at Taka 5,64,000 crore in the next fiscal year 2025-26, which will be 9.0 percent of the GDP. “Of this, I propose to collect Taka 4,99,000 crore through the NBR sources and Taka 65,000 crore from other sources,”

Non-development expenditures will rise, with major allocations earmarked for debt servicing, food subsidies, and banking sector reforms. The non-development expenditure would reach Taka 560,000 crore, an increase of Taka 28,000 crore compared to the current fiscal year’s allocation.

Besides, subsidies for agriculture, fertilizers, and electricity will continue to support key industries. The budget witnessed steps to reduce the cost of doing business and align tax policies with the requirements of LDC graduation.

Long-term projects are not being included in the development budget, and no new mega project is being initiated — except for the Matarbari development project, which was already in progress.

The key features of the budget include: Rise in safety net coverage and payments, online shopping will become costlier, tax-free income limit to go up from FY27, cost of flats to go up, source tax on supply of essential commodities has been halved, cut on advance tax on industrial raw materials, duty-free import of cereals, life-saving drugs to continue, corporate tax may rise for non-listed firms, customs duty on medical equipment may be waived for large hospitals, duty exemption to give relief to pharma industry, chronic patients, tax on land transfer to be reduced, income up to Tk 500,000 from agriculture is tax-exempted, no surcharge on electric car.

Comments Here: