৩০ মাঘ ১৪৩২

Trump Administration Plans to Impose Tariffs Up to 200% on Medicines

02 September 2025 17:09 PM

NEWS DESK

The Trump administration has proposed steep tariffs on imported medicines, with officials publicly floating levies as high as 200 per cent on some drugs, as reported by AP.

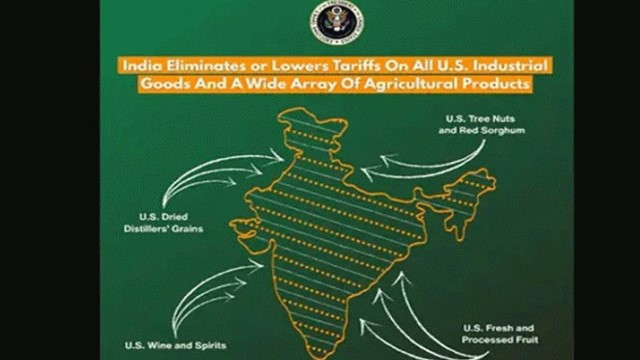

US President Donald Trump aims to extend tariffs, already applied to goods like autos and steel, to the pharmaceutical sector. That would mark a sharp break from decades in which many medicines entered the United States duty free.

Experts say the policy could push up prices and interrupt supply chains. Shortages are a real risk.

Officials invoked national security under Section 232 of the Trade Expansion Act of 1962 to justify the move. The argument is that domestic production must rise after the shortages and stockpiling seen during the COVID-19 pandemic.

A recent US–Europe trade outline already set a 15 per cent tariff on some European goods, including pharmaceuticals, and the administration is threatening far higher duties on other imports.

The White House has suggested delays of a year to a year and a half to give firms time to adjust. Many companies have already increased imports and built inventories.

Leerink Partners analyst David Risinger said in a July 29 note that most drugmakers have already increased drug product imports and may carry between six and 18 months of inventory in the US.

Jefferies analyst David Windley warned that tariffs that do not start until late 2026 may not bite until 2027 or 2028. Short term, then, the disruption could be modest. Longer term, the pressure on costs and supplies will grow.

“A tariff would hurt consumers most of all, as they would feel the inflationary effect ... directly when paying for prescriptions at the pharmacy and indirectly through higher insurance premiums,” Diederik Stadig of ING wrote in a commentary last month.

Low-income households and older patients would be most exposed, experts say.

Stadig adds that even a 25 per cent tariff could raise US drug prices by 10 to 14 per cent as stockpiles run down. That is not a small number for people on fixed incomes.

Some large companies have already announced big US investments. Roche said in April it will invest USD 50 billion to expand US operations. Johnson & Johnson plans to spend USD 55 billion in the United States over the next four years, and CEO Joaquin Duato has said the firm aims to supply the US market from domestic sites.

Still, investment pledges do not instantly replace the foreign-made active ingredients used in many products.

Many analysts doubt the top figure will be applied across the board. Exemptions are possible, especially for low-margin generics. The administration may settle for a lower levy.

But uncertainty alone can reshape markets. Producers may change which drugs they sell in the US. Kotak Institutional Equities says companies could cut their US portfolios or exit certain low-margin lines if tariffs stay high.

India supplies a large share of global generics and provides crucial active ingredients. Sudarshan Jain, Secretary General of the Indian Pharmaceutical Alliance, told that the Indian pharmaceutical industry has been “excluded” from the US’s immediate tariff enforcement because generic medicines are “crucial” for affordable care in the United States.

Sandeep Pandey, co-founder at Basav Capital, noted that India’s share of US pharmaceutical imports is roughly 6 per cent and that US policymakers recognise the system’s dependence on Indian supplies.

A production pause at a factory in India a few years ago led to a chemotherapy shortage. “Those are not very resilient markets,” Marta Wosinska of the Brookings Institution said. “If there’s a shock, it’s hard for them to recover.”

She adds a policy caveat, which goes to cost and political will. “In an ideal world, we would be making everything that’s important only in the US,” Wosinska said. “But it costs a lot of money ... We have offshored so much of our supply chains because we want to have inexpensive drugs. If we want to reverse this, we would really have to redesign our system ... How much are we willing to spend?”

Courts have already pushed back. The US Court of Appeals for the Federal Circuit struck down parts of the tariff move and found that Congress, not the president alone, has to authorise sweeping economic measures. That ruling was temporarily stayed and the dispute is headed for further appeals. The case could reach the Supreme Court.

Political noise is growing too. The president has used social media to signal new alliances and has asked firms like Pfizer for full vaccine data, intensifying scrutiny of public health policy.

Expect the slow burn. Stockpiles may delay immediate shortages. But if tariffs stand and supply chains do not change, price rises will follow.

If you rely on regular prescriptions, check with your pharmacist about alternatives. If you manage a business that buys medicines, review supplier contracts and lead times. Watch court rulings and official tariff lists for exemptions that could spare certain products.

The tariff threat forces a trade-off between two goals. One is greater production resilience in the United States. The other is keeping medicines affordable and widely available today. Policymakers face a hard choice and so do patients.

Comments Here: